Getting Started

There are many finance-related terms that kids need to learn. Unfortunately, these are not often taught in school. I am often surprised when I learn how little some adults know about money and personal finance. Terms that some consider simple and crucial to understand such as interest, taxation and dividends are still a mystery for many.

Table of Contents

ToggleThese same people probably still remember much that they were taught in school such as how to calculate the area of a triangle or lines from a poem or important historical dates and events. But ask them to explain compound interest or depreciation and you are likely to be met with a blank stare.

What We Don’t Learn At School

The education system in many ways is preparing students to be productive workers. The jobs that you will end up working in may not even exist yet, but you are still being taught knowledge and skills in a way that has remained largely unchanged for generations.

Some subjects may provide benefits in terms of skills that will allow graduates to become problem solvers, critical thinkers and investigators (researchers). These will no doubt come in handy. Other subjects will provide less value for the majority of us. (I’m still waiting for that day when the calculus that I learned in Grade 12 Mathematics will provide me with some value)

But some of the most basic and yet most crucial knowledge and skills continue to be neglected. Financial literacy and the knowledge of how to create wealth in ways other than working a 9 to 5 job should be required in secondary school. Imagine if rather than learning trigonometry or poetry, we learned about how to balance a checkbook, invest in the stock market or start a small business.

I’ve nothing against mathematics or poetry. I can still remember every word of Robert Frost’s “The Road Not Taken”. Unfortunately though, for the education system, the road not taken is the road to the very financial freedom that we all desire.

So, let’s get started on our own road not usually taken. Let’s find out all of that stuff that I wish I had learned in school. Money is not a dirty word. There are no ‘secrets of the rich’ and there is nothing complicated about getting rich. You just need to learn how the world really works.

But we need to start with some vocabulary.

Money Terms

Money is simply a tool that we use to get the things that we need and also the things that we want. Every country has its own name for this money (currency) but it’s still the same thing. Most people work at a job to earn this money and we generally call this money earned in our job our income. Other terms we use are salaries (more of an annual amount word) and wages (generally based on an hourly rate).

People work full-time and part-time jobs and their income is mostly spent consuming goods and services. Hopefully, some of this income is also saved, mostly in banks and in return for putting money in a bank, the saver receives interest. Interest is simply the cost of borrowing money. When we borrow from a bank we pay interest. When we save in a bank we receive interest.

Taxation

But we don’t receive all of our income. We also have to pay some income tax to the government. This tax money is used by the government to provide public goods and services such as roads, street lighting and pensions to the elderly. It’s important to understand how your country’s taxation system works so that you are certain that you are paying the correct amount of taxation.

Investing Terms

Though we can get by having a job, spending and saving money and paying our taxes, we should also strive for ways to make our money grow. This is essential to have enough wealth to live off when we can no longer work. It will also improve our quality of life overall.

Saving money in a bank provides only a very small amount of growth due to the savings account interest being very low.

Hence we need to find ways to get greater returns from our saved money. The way to do this is to invest. Investing is basically putting your money to work for you. For example, you could start a business.

Another way to invest is to buy shares in companies. These shares (also known as stocks) are basically tiny parts of companies. The good news is that anyone can buy shares. You get to own a small part of a business and the business uses your money to help it grow further. In return, the business usually pays you a small share of profits. We call these payments dividends. They are often paid to the shareholder three or four times a year.

Another way that wealth can grow through investing in stocks is through the fact that over time the value of stocks tends to rise. In fact the US stock market has averaged around 9% growth over the past one hundred years.

Compound Interest

When you receive this growth, your wealth compounds. We call this compound interest. Let’s suppose that you invest $1000 and earn 9% after one year. You would now have $1090. The next year you would not receive 9% of $1000 but 9% of the $1090 that you now have. Hence your 9% return now gets you just $98.10 rather than the $90 of the previous year.

Over a long period of time this compounding can become very powerful. It’s so powerful that your investment can double approximately every 7-8 years.

Index Funds

Investing in individual companies can be a little risky if you don’t have detailed knowledge of the company that you are investing in. Share prices can be quite volatile and you could lose money if companies crash.

An alternative to trying to ‘pick’ which companies to invest in is to invest in every company. Some will rise and some will fall, but on average the trend has been that the market rises. It is possible to invest in an entire stock market or a large part of it by buying index funds.

An index fund basically amounts to buying a little piece of a large number of the biggest companies. For example, the S&P 500 is an index that comprises of the top 500 US companies. This form of investing is considered safer than investing in individual companies.

Bonds

Investing in stocks can be quite profitable. But it can provide a little more risk than some people wish to have. For example, if a person is close to retiring and needs to access their investment account, then they want to know that its value is quite stable.

Bonds represent a safer option, though returns are generally lower than stocks.

Bonds are similar to stocks but they are issued by the government. Think of them as basically you lending money to the government and receiving interest. This interest is greater than what you would receive from a savings account but could be less than you would receive from an index fund.

Your investment still compounds, but at a slightly slower rate and with slightly less risk and volatility compared to stocks.

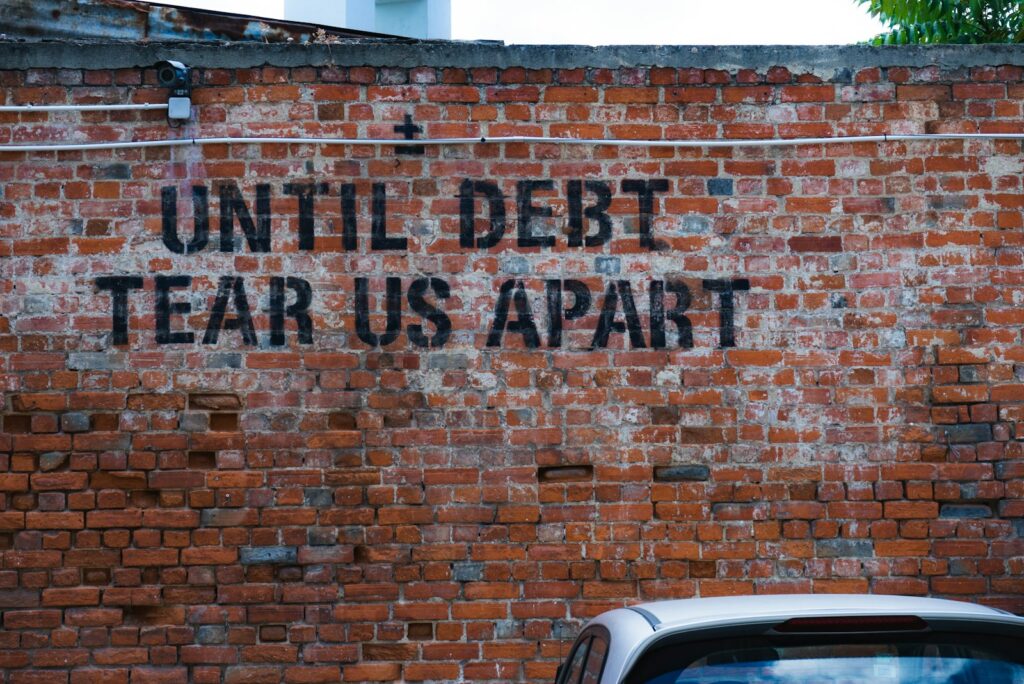

Debt

Investing your savings can help you to accumulate wealth. However often people feel that rather than saving and investing they should spend all of their income to satisfy their needs and wants. When this is not enough, the option is to borrow from a bank in order to meet these needs.

The items that most people borrow for include cars and homes. However many consumers also use credit cards to purchase other items that they cannot afford at a particular point in time.

Of course, borrowing money means paying interest. This interest can be quite high, especially when we are talking about credit cards which often charge around 20% per year on any outstanding debt.

In the same way that investment can create wealth through compounding interest, debt can also compound and lead to the opposite occurring. Monthly loan repayments reduce the income available for saving and investing and can lead to a vicious cycle of debt that can be difficult to break out of.

The Simple Path to Wealth

This may be starting to sound a little complicated. But acquiring wealth can also be extremely simple if you stick to some basic rules. I wish these rules were taught in school. Unfortunately, they are not. But here they are.

- Avoid debt

- Spend less than you earn

- Invest the difference

It is really important that young people learn these terms and start to think about how they will manage their money in the future. Starting with vocabulary and seeking out resources to further understand the world of money can be life-changing. There are no real secrets of the rich. There is actually a pretty simple path to wealth. I hope that you find it.