Table of Contents

ToggleHow Can A Teacher Become A Millionaire?

Most teachers, whether they are teaching in their home countries or teaching overseas, probably won’t ever imagine becoming a millionaire. Sure, there are benefits that come with our profession, but accumulating huge wealth doesn’t appear to be one of them, at least compared to many other professions. However, you may be surprised to hear that a national US survey conducted by Ramsey Solutions in April of this year (2023) found that teachers ranked number 3 in the top careers for millionaires.

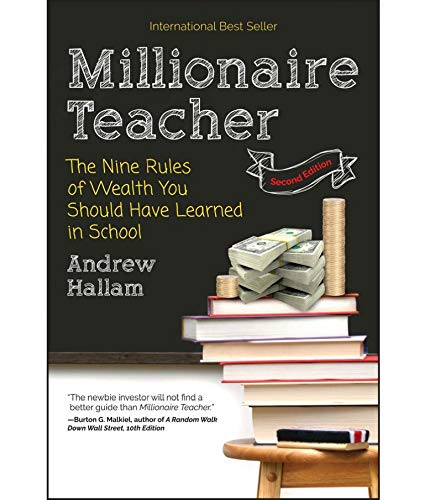

One such millionaire, Andrew Hallam provides strategies for achieving exactly this. Hallam is a personal finance author and speaker from Canada. He was formerly a middle school teacher in British Columbia and also taught in an international school in Singapore. Hallam’s book Millionaire Teacher is about becoming a millionaire on a teacher’s salary. He also wrote The Millionaire Expat.

I Wish I Learnt That In School

As a teacher as well as an ex-pat it made sense for me to read both of these books. I would like to share some of the key takeaways as well as add my spin to them. The full title of the first book is “Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School”

I love this. How often have we heard the phrase “ I wish I learnt that in school”?

It’s no surprise that Hallam actually did teach this stuff to his students in Singapore. I’ve no doubt that they would have loved it. I run a Young Investors club at my school which came about from student requests. Kids need to know this stuff, but they also really want to. But so do we teachers and the rest of the world too.

So How Exactly Do Teachers Become Millionaires?

So how does a teacher become a millionaire? Well, before getting to that, it’s worth noting that being a millionaire isn’t what it used to be. There are a few more of them these days and a million dollars doesn’t actually go that far any more. (Try buying a house on Sydney’s north shore.) We should all be setting a million dollars as a goal, just to be able to retire reasonably well. If you are young then that figure needs to be much higher.

So, the more pertinent question really is ‘How can a teacher (or anyone on a similar wage) become financially independent?’

I think teachers do have great potential to be able to accumulate wealth if they only knew how. But many things tend to get in the way. Expat teachers may earn more than they would in their home countries. But they work overseas so that they can travel easily, and travel can be expensive. It’s pretty common for teachers working overseas to take 3-4 international trips a year.

Lifestyle creep is the situation where we spend more as we earn more. Hence those on higher incomes often don’t actually save any more than the rest.

Do You Have A Millionaire Next Door?

But there is hope. Another great book that I read recently is called “ The Millionaire Next Door”. In his book, Dr Thomas J Stanley conducted extensive research to find that most millionaires don’t ‘look’ or ‘live’ like millionaires. He identified 7 common traits of millionaires and these were more prevalent in teachers than in almost any other profession. In fact, a huge number of the ‘millionaires next door’ were teachers.

Millionaires aren’t always what or where you think they are. Don’t go looking for them in the most expensive suburbs of the most expensive cities in the world. Here you will see people who look rich with their flash cars and houses. But most are living beyond their means and riddled with debt in an attempt to look richer than they are.

Thomas Stanley couldn’t find too many millionaires in the richest US suburbs. He found them in normal suburbs, living in normal houses and driving normal cars that were 100% paid for. He found that these millionaires bought second-hand cars with cash and paid off their houses incredibly quickly while investing in the stock market and real estate. They didn’t eat at expensive restaurants and didn’t shop at high-end stores. But they owned lots of assets that continued to accumulate more and more wealth.

So it is possible. If we take the advice of financial experts such as Hallam and apply some simple rules, it can happen to you too. The rules are simple. They are also foolproof. But that doesn’t make them easy.

Here is a list of some of the key things that I’ve recently learned and am trying to apply myself. I’ve taken a couple of Hallam’s 9 rules, modified them a little, fused some other ideas from other experts and added my twist.

My 6 Rules That Will Help Anyone Become A Millionaire

Rule 1: Pay Yourself First

You need to have a certain percentage of your income that goes somewhere before you can get your hands on it. The moment it reaches us it ends up being someone else’s money. It becomes the money of the airline, the electronics store, the landlord or the restaurant as well as to the government in the form of taxes. Pay yourself before it’s all gone.

Rule 2: Make It Automatic

Set up systems that make taking a portion of your income for saving or investing automatic. We don’t miss what we don’t see. This is what allows you to keep paying yourself first. Sending money to retirement funds also offers great tax advantages and sometimes the employer has to match your contribution. A double bonus when you collect it all at the end.

Rule 3: Spend Less Than You Earn: Invest The Difference

Simple right? Spend less than you make. Most people see having extra money towards the end of the month as an opportunity to just buy more stuff. More stuff probably isn’t going to help you to be more financially secure in your future years. Investing wisely will.

Rule 4: Invest In Index Funds And Start Early

I’m not going to go into what index funds are or argue the case for investing in them. That will be a whole other blog. As far as I’m concerned, the evidence speaks for itself and the experts that aren’t trying to rip you off all agree too. In terms of understanding compound interest, well Albert Einstein said it best when he said

“Compound interest is the eighth wonder of the world. He who understands it earns it…he who doesn’t… pays it.” So understand it. (see rule 5)

Rule 5: Educate Yourself

The resources are there. There are a thousand books that you can read. Most of them say all of the exact same things. Yet these are still things that the majority of the population was never taught and still don’t know. It actually isn’t that complicated. But I believe that many financial advisers want us to ‘think’ that it’s complicated.

Rule 6 (more of a philosophy than a rule perhaps): Understand The True Cost of Money

Whenever you are about to spend, consider the true amount of time and effort that went into earning the money that you are thinking of spending. We wake up early, travel to and from work, and spend money on work clothes and work lunches, we stress and spend time away from family.

We give up an awful lot to earn that pay packet. How easily should we be giving it away? Ask yourself, will this huge flat-screen tv or new iPhone improve my quality of life at all?

Some Other Considerations:

Many experts add that we should completely remove all debt. Debt can be crippling but there is such a thing as good debt. Each of the rules requires some form of self-discipline or something that takes away the need for discipline. This could apply to debt too, especially credit card debt.

Avoiding lifestyle creep would be another good rule.

Imagine how much we could save if we just lived the same as we did when we were at university or in our first job.

If you are trying to reduce your consumption of environmentally damaging products and see overconsumption and consumerism in general as a bad thing then this is extra motivation to just stop buying crap. You now have a huge advantage in the pursuit of financial freedom.

This applies also to those that have embraced a minimalist lifestyle. Save money on buying consumer goods and then make the choice to either spend on experiences rather than possessions or invest for the future. Spending on your own education is another good investment to consider.

Yes, it is possible to make some changes to our spending. But we can also make changes to our income.

Increase your income

Many enterprising teachers have side hustles like tutoring, selling video lessons, teaching English online or creating and selling teaching resources. There’s also the horrible act of marking final exams if you are really keen. Dedicate some portion of your holidays to working on something that can add to your income.

A summary

Everyone can do better in terms of acquiring wealth if they really want to. But what are we prepared to give up and when are we going to start?

Are we content with spending it all and struggling in retirement? Or being supported by our government or our family when we stop working? Or can we take action now, put a plan in place, tighten our belts just a little and stress less about the future?

I can’t imagine being a millionaire any time soon. And maybe I’ve started a little too late. But I’m more confident now that retirement when it comes will be pretty ok. You don’t need to give up everything now, but you do need a plan.

Start now and maybe you will in fact become a millionaire teacher.

Related articles:

The Stock Market: All You Really Need To Know For Now

Buy on Amazon:

Very well-written and funny! For more information, visit: DISCOVER HERE. Looking forward to everyone’s opinions!

Excellent article! I appreciate the thorough and thoughtful approach you took. For more details and related content, here’s a helpful link: LEARN MORE. Can’t wait to see the discussion unfold!

You state ”imagine how much we could save if we just lived the same as we did when we were at university or in our first job.”

Not too many people want to spend their lives living like a broke university student. Seems to me like an awfully sad existence. And marriage (at least if you want kids) is off the table. Children are expensive. And not too many women want to marry someone who insists on living well below his means and just spending enough to ‘get by’. If you want to live your entire life like a monk in order to save as much as possible…what do you do with the money you save when you pass away?

I get what you are saying…I just think the comment you made was rather extreme.