Table of Contents

ToggleKnowledge Is Power

And Reading Books Gives You Knowledge

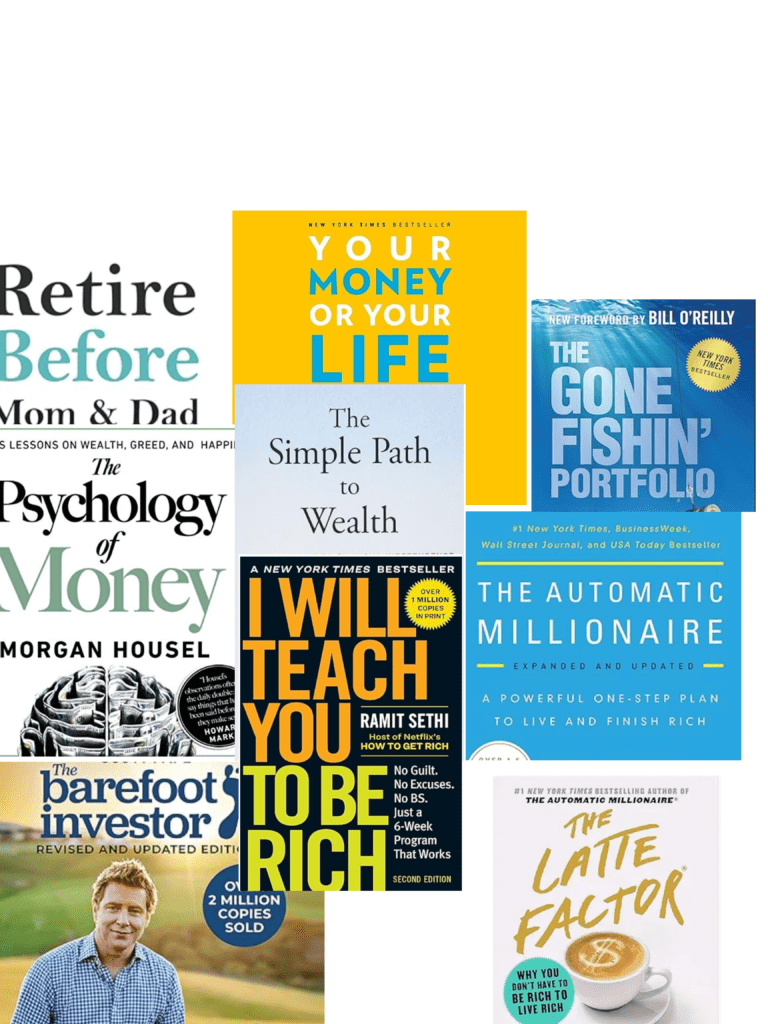

It is fair to say that there have been quite a few personal finance books written over the years. Many preach the same messages as this top 10 list again shows. However, there still seems a need for this advice as most people continue to follow a very different path to the one that would gain long-term wealth and financial freedom.

Here is The Finance Teacher’s 10 Best Personal Finance Books that you should read this year. Well, maybe not all of them, but I guarantee that just one could change your financial life.

I Will Teach You To Be Rich

I Will Teach You To Be Rich by Ramit Sethi

This book provides practical advice on personal finance, focusing on saving, investing, and automating your finances to achieve wealth and financial freedom. It’s a 6 week program full of practical advice and tips to reduce debt and to achieve what Ramit calls ‘Your Rich Life’ Check out his Netflix series ‘How To Get Rich’ as well.

Why it’s so good:

It provides a practical step-by-step plan that anyone can follow

The Psychology Of Money

The Psychology Of Money by Morgan Housel:

This book explores the psychological aspects of money management and delves into the behaviour and emotions that influence financial decisions. It’s truly one of the best things that I’ve ever read. It explains clearly through real-world examples the problem that many people have with their relationship with money. As Morgan says, we’re not all crazy, but we have different life experiences that affect how we treat money. Changing this relationship can change our lives.

Why It’s So Good:

It helps the reader to reassess everything that they have done with money and to begin a better path.

Your Money or Your Life

Your Money Or Your Life by Vicki Robin and Joe Dominguez:

This classic book has become the bible of the FIRE movement. FIRE stands for Financial Independence Retire Early. It offers a nine-step program to transform your relationship with money and achieve financial independence by changing your spending habits and investing wisely. It includes some familiar themes emphasising frugality and measuring money in terms of the time that it takes to make and the time that it takes away from our lives.

Why It’s So Good:

It gives confidence that it really is possible to retire early and shows how to do it.

The Simple Path to Wealth

The Simple Path To Wealth by J.L. Collins:

Brought to life originally from a blog aimed at providing a father’s advice to his daughter, this book advocates for a simple and effective approach to building wealth through investing in low-cost index funds and adopting a frugal lifestyle. Yes, it is simple but it just all makes sense after reading this book.

Why it’s so good:

It offers a simple explanation of how the stock market works and how investing in index funds is the simple path to wealth.

The Automatic Millionaire

The Automatic Millionaire by David Bach:

The book emphasizes the importance of automating your finances, including automated saving and investing, to build wealth over time. In the book, David Bach recalls discussions with success stories of people using the ‘automate your savings and investments’ strategy.

Why It’s So Good:

It emphasises the power of making things simple and ‘Paying Yourself First’ to help automate an investment plan without missing the money that you are investing.

The Latte Factor

The Latte Factor by David Bach:

This book highlights the impact of small daily expenses, like buying coffee, on your long-term financial goals and suggests ways to save and invest wisely. Yes, it’s about cutting back on your lattes. But it isn’t really. The daily latte just represents anything that we can cut from our spending that can be invested for the long term. It’s all about the power of compounding, as pretty much all of these books here are.

Why It’s So Good:

Bach uses a fictional story with believable characters to explain how small changes can make a huge difference in our financial future.

The Millionaire Next Door

The Millionaire Next Door by Thomas J. Stanley and William D. Danko:

Based on extensive research, this book reveals the common traits and habits of millionaires, emphasizing frugality and disciplined saving. When looking in the wealthiest suburbs to study millionaires, the authors found people living millionaire lifestyles financed by debt. It was in the suburbs where they found average people who had grown their wealth steadily to reach millionaire status.

Why It’s So Good:

This book breaks all the myths of how most millionaires act and what got them to where they are.

Retire Before Mom And Dad

Retire Before Mum And Dad by Rob Berger:

This book offers strategies for young adults to achieve financial independence and retire early. The emphasis is on long-term investing and cutting back now to turbocharge the compound investment effect to reach your financial goals.

Why It’s So Good:

It offers inspiration and a plan to break the cycle of debt and an uncertain financial future by fast-tracking investing and retiring early.

The Gone Fishin’ Portfolio

The Gone Fishin’ Portfolio by Alexander Green:

This book discusses an investment strategy that aims to simplify investing while achieving long-term financial goals with a diversified portfolio. Written by a well-renowned investor, it explains exactly how to use the stock market to your advantage without the often associated risks.

Why It’s So Good:

One of the very few finance books that provides expert advice along with complete instructions on exactly how and where to invest for a risk-free investment portfolio.

The Barefoot Investor

The Barefoot Investor by Scott Pape:

This Australian bestseller provides actionable steps for managing money, getting out of debt, and achieving financial security through a simple, practical approach. This was one of the first personal finance books that I read. My daughter gave it to me and it was one that really started me on the journey of improving my finances. I revisited it this year for another read.

Why It’s So Good:

It’s written by a financial advisor but for the average person with practical tips and a proven system that works. It has an Australian focus and some cheesy jokes. But it’s great.

Conclusion

They are all good in their own right, hence I decided not to rank them in any way.

I’ve read (or listened to) them all this year and can honestly say that each one has helped me in a different way from the rest. I hope that one of them can make a difference for you too.

Related post: How Books Are Changing My Life

Very engaging and funny! For more information, visit: EXPLORE FURTHER. Let’s chat!