Plant Your Tree And Watch It Grow

It’s only natural to want things to happen in a hurry. We want to erase our debt instantly. And we are always attracted by ‘get rich’ schemes that promise a lot and rarely deliver anything. The reality is that debt takes time to remove and wealth normally takes time to acquire. Investing for the long term is far better than any ‘get rich’ scheme.

If we are trying to improve our financial situation later in our lives, then it seems that there is more urgency to create wealth in a hurry. Sure, there are ways to become wealthy in a reasonably short time. Establishing a business and putting in the hard work along with a certain degree of luck can yield wealth. But many businesses fail.

Successful entrepreneurs are a special breed of risk-takers and investors and deserve all of the success that comes their way. Many have failed numerous times before finding success. The road to riches can be a tough one. Wealth rarely comes quickly and if it does, then it is the small percentage of businesses that manage to achieve it.

Simple, Safe, Slow And Boring

But there is a simple, safe, slow and rather boring way of creating wealth. The only catch is that you need a lot of time. Hence the earlier you start the better off you will be. This can of course also be combined with seeking wealth in other ways such as investing in a business.

The simple, safe, slow and boring route involves investing in safe investments and relying on the magic of compound interest. To truly understand the power of compound interest we need an example. We also need to understand exactly how compounding works.

Compound interest is the interest that you earn not only on your initial investment but also on the interest that you’ve earned over time. It’s like interest on top of interest.

The really boring bit: Please stay with me through this. I promise it gets better.

Let’s use an example to illustrate how compound interest works. Say you invest $1,000 at an interest rate of 8% per year. After the first year, you’ll earn $80 in interest. So, your investment is now worth $1,080. In the second year, you’ll earn interest not just on the initial $1,000, but also on the $80 in interest that you earned in the first year. This means that your investment will grow to $1,166.40 after the second year.

The longer you let your investment compound, the more it will grow. After 10 years, your investment will be worth $2159. Now, this isn’t going to make you rich. But this is just looking at that single $1000 investment. What happens if you invested $1000 every year for those 10 years? You would then have a total amount of $14600. This doesn’t make you rich either. But remember that in this example we are only investing a small amount (around $85 each month)

Start paying close attention now as we ramp things up a little

Let’s now really add the power of time. Let’s assume that a young person, who we’ll call Jane, who has been taught this strategy begins automatically deducting $85 each month from her salary (the same $1000 per year) beginning with her first job at the age of 20. As Jane has made it automatic, she can just forget about it for her entire life. She continues to work or run a business, not even remembering the measly $85. She may have other investments and expenses along the way. She may become rich or she may not.

One day, Jane remembers her investment and checks in on its progress. It’s probably not worth that much she thinks, at the age of 40 when considering putting a deposit on a house or paying some of her child’s university fees. She discovers that the investment has now compounded to $46, 677.

At the age of 60, and thinking about whether she can retire early, Jane sees that the investment is now worth $264, 238.

And at 70, when enjoying retirement, she sees that the small monthly investment is now worth $585,246.

Do these figures seem unbelievable?

Well, you can easily check them yourself with any online compound interest calculator. The thing is, like all compounding, the gains are smaller in the beginning and greater towards the end of the time period.

Ten years later, when considering how much inheritance to leave to children and grandchildren, the sum has now grown to $1,278278. All of this is from investing just $85 per month.

Why not round it up to $100 per month. After 60 years we have $1,503,856.

Now the exciting bit

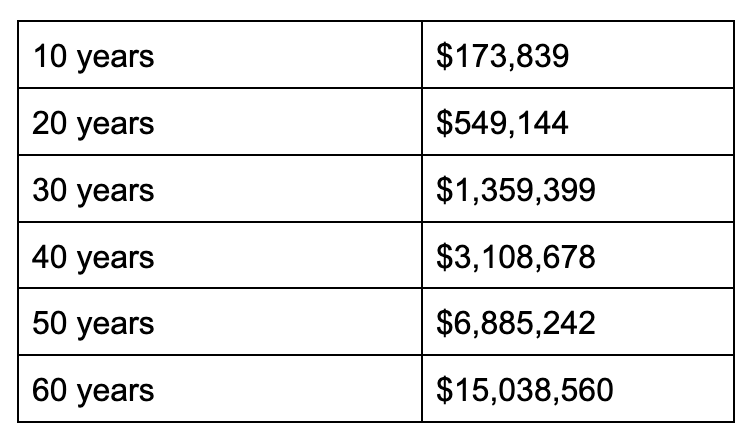

Just imagine if you could instead invest $1000 each and every month at an 8% return. Here we go:

This is the point where I almost start to cry. I start to wonder, why nobody taught this to me when I was 18.

Sure, at 18 you may only be able to save the $85 per month and not the $1000. But as our salaries rise over time, we can progressively save more. We may even be able to exceed the $1000 each month in our middle years of working.

Now you have probably been wondering two things, and I apologise for saving these to the end. Firstly, you may be wondering where I got the 8% from and if that is really achievable.

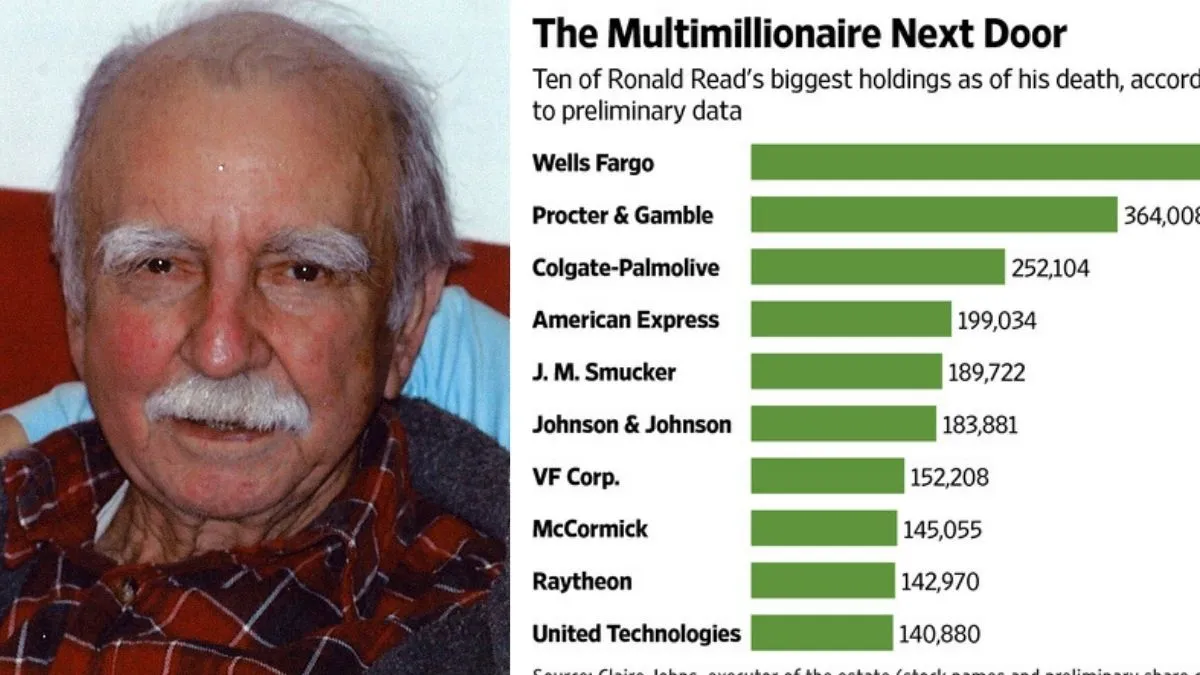

The fact is that if you invest in the stock market over the long term you can expect to get 8%. , The stock market has averaged returns of 10% over the past 50 years.

The second question may be, ‘Exactly how do I invest safely in order to get that 8%?’ The answer is index funds. An index fund can track the average of the stock market by investing in the top 500 companies, hence returning roughly the average or even higher than the average of the stock market over the long term.

I talk about the stock market and index funds in other blogs that you can check out if you wish.

But the lesson from this blog is simple. Time and compounding are incredibly powerful. It’s best to start early, then set, forget and eventually reap the rewards.

As the Chinese proverb says: ,“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

The same applies to investing. So start now.

Related links:

Excellent read! The points made here are compelling. Id love to dive deeper into this topic. Click on my nickname to join the conv