Introduction To The Personal Finance Books To Read In Your 20s

If you’re currently in your 20’s, then you are going through a significant time in your life in terms of your finances and your future financial wellbeing. You are completely in control of your own financial destiny. I hope you are prepared. This article will suggest the top 10 personal finance books to read in your 20s.

Table of Contents

ToggleIf you aren’t reading these books or similar ones then you are really missing an opportunity to grow your wealth. When I was in my 20s, my finances were a mess and I was completely clueless. It was a decade of finding my way, through university study, work and relationships. And many financial challenges.

I had very little understanding of effective ways to manage my money and was not particularly responsible with my spending or my use of credit. But did anyone suggest to me that I should read a personal finance book? No. I wish I had been provided with some of this very important advice when I was that age.

Develop The Habit Of Reading

We live and learn from experiences and mistakes. But developing a habit of reading can make all the difference. I’ve read them all and can safely say that I have learned something important from each book on this list. The 20s are such an important time in a person’s life. I hope that you can use this article to get started on your learning journey.

Teach Yourself About Personal Finance

Ideally, the subject of financial literacy should be taught in schools. However, we also have a responsibility to educate ourselves in the best way possible. The current decade offers so many ways to be resourceful to learn the crucial financial literacy skills that can help us on the path to a more secure financial future.

Whether it be Youtube channels, websites, blogs or books, there are really no excuses if we are prepared to learn.

As a teacher, I understand the importance of instilling wisdom as early as possible. In this blog post, we will explore a curated list of finance books tailored for young adults, providing valuable insights into managing money, investing wisely, and building a strong financial foundation. I’ve selected those that are not complicated and that provide practical advice.

Finance Books To Read In Your 20’s

Let us begin with a classic ….

1. “Rich Dad Poor Dad” by Robert Kiyosaki

No list of finance books is complete without mentioning this one. Sure, it’s a little old now. It was written in 1997. But it still has some pearls of wisdom. Robert Kiyosaki’s “Rich Dad Poor Dad” challenges conventional beliefs about money and introduces readers to the concept of assets and liabilities. Through relatable anecdotes, Kiyosaki encourages a mindset shift that is crucial for financial success.

My biggest takeaway from this one is the emphasis on buying assets rather than liabilities. Assets are things that put money in your pocket, whereas liabilities cause cash to flow away from you.

Most people consider cars and houses to be assets. However, a car loses value over time and does not create cash flow. Financing a car causes a negative cash flow. Houses are generally the same, however they may appreciate over time. This is good, but houses do not bring in cash unless they are used to generate rental income.

“Rich Dad Poor Dad” also refers to what Kiyosaki calls ‘the cashflow quadrant’ which I like.

It explains that most people are either employees or self-employed. But the rich are generally either business owners or investors. We should aim to earn from the right side of the cash flow quadrant as seen in the diagram below.

2. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Stanley and Danko conducted extensive research to uncover the common traits of millionaires. Contrary to popular belief, many millionaires live modest lifestyles. “The Millionaire Next Door” reveals practical habits and principles that can guide young adults towards accumulating wealth and making sound financial choices.

Key takeaways from this excellent book include the observation that many rich people live in the suburbs, spend responsibly on accumulating assets and only incur debt when investing in real estate or their own home.

The authors looked for millionaires in the supposed ‘rich’ areas of cities but found that many people living in these areas were living lavish lifestyles but were reliant on debt to maintain their lifestyle. The real millionaires had accumulated their wealth over time and put in place responsible strategies that included an element of frugality.

3. “The Total Money Makeover“ by Dave Ramsey

Dave Ramsey is a renowned financial expert, and “The Total Money Makeover” provides a step-by-step guide to achieving financial freedom. This book emphasizes the importance of budgeting, eliminating debt, and building an emergency fund. Ramsey’s straightforward approach is both motivational and actionable.

I put this one in the category of how to get back on track after making some serious mistakes. Ramsey’s books are great for those who want to get out of debt and build future financial success through discipline and a step-by-step plan that works. His views on debt are quite extreme. This could be the perfect book for anyone who wants to completely eliminate debt. But this may not work for everyone.

4. “The Intelligent Investor” by Benjamin Graham

For those interested in delving into the world of investing, “The Intelligent Investor” by Benjamin Graham is a must-read. Often referred to as the “bible of investing,” this book offers timeless principles on value investing and risk management. Graham’s insights have influenced some of the most successful investors, including Warren Buffett.

This one may be a little dry for the average young person, looking for basic personal finance advice. But it is a good first-up investment book that will no doubt benefit the reader in the long term

5. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

“Your Money or Your Life” goes beyond traditional financial advice by exploring the connection between money and life satisfaction. The authors guide readers to reassess their relationship with money, achieve financial independence, and align their spending with their values. This book is a valuable resource for those seeking a more meaningful and intentional approach to finance.

This book has had a lasting influence on me personally. I like to idea of calculating the value of your money based on the total amount of time that it takes to earn. It makes the reader think about spending in a completely different way. It addresses our relationship with money and spending to create life value rather than to purchase material possessions.

The other important feature of this book is the goal of eventually getting your money to do the work for you. This book is one of the inspirations behind the FIRE movement (Financial Independence Retire Early)

6. “The Richest Man in Babylon” by George S. Clason

Set in ancient Babylon, this timeless classic imparts financial wisdom through parables and stories. “The Richest Man in Babylon” covers fundamental principles such as saving, investing, and avoiding debt. The simplicity of the narratives makes it an engaging read for young adults.

This book isn’t that long and is an easy read if you can get over the use of ancient language that is used to provide the context. For example “Gold cometh gladly and in increasing quantity to any man who will put no less than one-tenth of his earnings to create an estate for his future and that of his family.”

I like the use of stories and relatable characters. The wisdom just oozes out of this book, so have your pen ready to write them down as you read.

7. “I Will Teach You To Be Rich” by Ramit Sethi

Ramit Sethi’s “I Will Teach You to Be Rich” is a practical and humorous guide to personal finance. The book covers topics such as banking, saving, investing, and automating finances. Sethi’s conversational style and actionable advice make this book an excellent choice for those just starting their financial journey.

This is a fairly recent addition to the required reading list for those of you in your 20s and beyond. It’s a 6-week program full of practical advice and tips to reduce debt and to achieve what Ramit calls ‘Your Rich Life’

Other key elements of the book are the references to a conscious spending plan that includes some indulgences in certain areas while cutting back in others. Check out his Netflix series ‘How To Get Rich’ as well.

8. “The Psychology Of Money” by Morgan Housel

This book explores the psychological aspects of money management and delves into the behaviour and emotions that influence financial decisions. It’s truly one of the best things that I’ve ever read. It explains clearly through real-world examples the problem that many people have with their relationship with money.

Of all the personal finance books to read in your 20s, this is the one that I wish I read. In fact I, recently lent my copy to one of my 16 year old students and he’s loving it.

As Morgan says, we’re not all crazy, but we have different life experiences that affect how we treat money. Changing this relationship with money can change our lives. It helps the reader to reassess everything that they have done with money and to begin a better path.

9. “The Latte Factor” by David Bach

This book highlights the impact of small daily expenses, like buying coffee, on your long-term financial goals and suggests ways to save and invest wisely. Yes, it’s about cutting back on your lattes. But it isn’t really.

The daily latte just represents anything that we can cut from our spending that can be invested for the long term. It’s all about the power of compounding, as pretty much all of these books here are.

Bach uses a fictional story with believable characters to explain how small changes can make a huge difference in our financial future.

10. “The Barefoot Investor” by Scott Pape

This Australian bestseller provides actionable steps for managing money, getting out of debt, and achieving financial security through a simple, practical approach. This was one of the first personal finance books that I read.

My daughter gave it to me and it was one that really started me on the journey of improving my finances. I revisited it this year for another read. It’s written by a financial advisor but for the average person with practical tips and a proven system that works. It has an Australian focus and some cheesy jokes. But it’s great.

Do They Need To Be Ranked?

I chose not to rank these as each person will find something different in each book and it may depend on your current level of understanding of personal finance and investment. But I will suggest a starting point and a more advanced point as well.

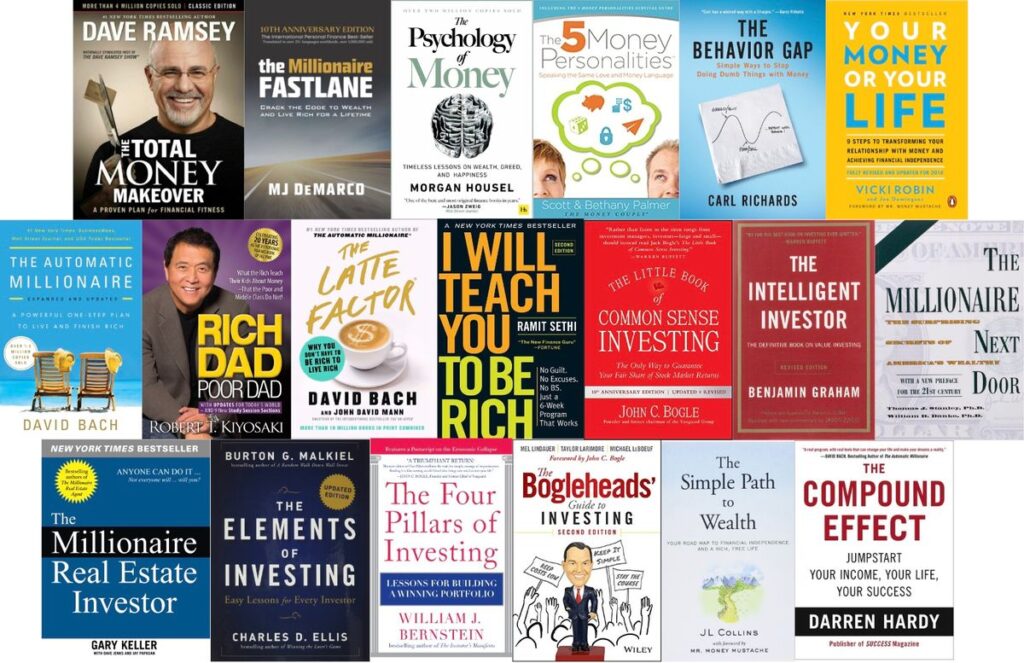

The absolute beginner may benefit by starting with “The Richest Man In Babylon”. “The Latte Factor” is another easy read that will get you started on the right path. “The Psychology Of Money” is probably my favourite book on this list. But you may prefer one that lays out step by step exactly what you should do. This is where “I Will Teach You To Be Rich” is great. But if you’re Australian then I would suggest “The Barefoot Investor instead. But I also suggest that at some point you read a book dedicated to investing, such as “The Intelligent Investor” or one of the other investment-focused books shown in the image below this article.

I suggest that you eventually read them all. But I doubt that I could have done that myself when I was in my 20s.

Conclusion

In your 20s (as well as in your teens), developing a solid understanding of personal finance sets the stage for a financially secure future. It should be taught in school but for some reason, it often isn’t.

These recommended finance books to read in your 20s provide a diverse range of insights, from foundational principles to actionable strategies.

Remember, the knowledge gained from these books can empower you to make informed decisions, cultivate positive financial habits, and ultimately achieve your long-term financial goals.

Happy reading!

I find that I can’t keep up with all of the reading that I want to do without using audiobooks. Being able to listen to books while commuting or walking is a game-changer for me. Check out Audible’s free trial if you haven’t tried it yet.

Very well-written and funny! For more information, visit: DISCOVER HERE. Looking forward to everyone’s opinions!

Pingback: Building Wealth in Your 20s: A Beginner's Guide